Tax policy 2007 – a rationale for tax levels cut

With the end of the summer holidays and the coming date for the submission of Budget 2007, discussions and debate over the next year tax rates have intensified. The changes of the corporate and individual tax laws were already approved on first reading by the parliament but they do not provide for the specific tax rates. Till the end of October the second reading of the bills should be passed and the revised tax parameters should be set in the national budget draft for next year that outlines the fiscal policy of the government.

At present, the Bulgarian taxpayers receive various signals about the upcoming revisions of the tax rates but there seems to be no consensus even among the coalition partners. Here are some of the directions of the discussion.

Taxation of personal income

The propositions of BSP about the changes to the personal income tax were greatly opposed by NMSII as well as by the right-wing parties. The proposal was to levy personal income tax at a rate of 28 per cent on incomes of more than 1 400 leva per month. This means that a new band should be adopted because at present all monthly incomes over 600 leva are levied by 24 per cent. The deputy minister of finance Mr. Kadiev opposed that idea by saying that according to National Statistical Institute (NSI) statistics only 17 thousand people would fall under the new category and that would lead to greater complications in the administration of the tax system, but few revenues into the budget. A simple cost benefit analysis of this proposal will show that the proposal will lead to negative effects for the economy. There are many costs to such action – greater administration costs, more incentives for hiding of income, less supply of labor and at the same time the benefits are zero.

Other proposed income tax changes appeal for an increase of the tax-free allowance up to 200 leva from the 2006 level of 180 leva and abolishment of one of the medium scales in the personal income tax bands – of 22 per cent. These would be positive revisions as they lead to flattening of the income tax and a reduction of the effective tax rate due to the higher tax-free allowance. Less tax burden, together with simplification of the tax payment process is the right path towards enhanced economic growth in the country.

After the abatement of the social security burden in 2006 to 36.7% of earnings from 42.7 per cent in 2005, a further decrease in social security rates in 2007 would be highly appreciated by the business and the workers. Last year the pension insurance security was reduced by 6%, and the portion of money going to the private pension funds increased form 3 to 4 per cent. The fiscal stability of the economy was not threatened, just the opposite – a budget surplus was realized that exceeded 1.3 billion leva (3.1% of GDP). The redistribution of the GDP through the government reached 42.9%, which is an indicator of an ineffective public finance governance and tax system.

In 2007 the portion to the private pension funds is set to rise to 5 per cent, but still, the system is inefficient and is not forward-looking to trends such as aging of the population and labor mobility. According to employers and workers social insurance contributions and taxes are too big a burden. The Bulgaria's social insurance burden is among the highest in EU and should be further reduced together with reformation of the current pension system. A private, capital-based pension system should replace the PAYG (pay-as-you-go) government system that is characterized by inherent problems and misbalances.

As a whole it seems that the government fails to reduce visibly taxation of personal income despite the high budget surplus that is expected to pass 4 per cent of GDP at the end of the year and the positive effects that the economy experienced after the social security tax cuts in 2006.

Taxation of business

BSP proposed a reduction of the corporate tax rate to 10 per cent form the current 15 per cent rate, but the most likely reduction of corporate tax rate for the moment is by 3 per cent – to 12 per cent rate. However, despite the pre-election promises, ceding of corporate tax on reinvested profit is still not among the priorities in the ruling coalition. Steps have been undertaken for adoption of the rules concerning the double-taxation and taxation of subsidiaries of EU companies in the country.

According to Doing Business 2007, index of the World Bank that indicates the regulatory costs of business in many countries, the effective tax that a medium size company in Bulgaria must pay in 2006 is 40.74% of gross profit. Entrepreneurs must make 27 payments, spend 616 hours to do the payment. Bulgaria has made a slight progress in the sphere of tax policy during the last years due to the decrease in social security rates, but still the average tax rates that are levied on business are higher than the rates of the most rapid-growing economies in the world. According to the indicator "Paying Taxes" Bulgaria has dropped by three places in comparison to 2005. There is no improvement in the overall estimated hours for paying taxes, neither in the number of payments.

Paying taxes (for 2006) in Bulgaria and some new EU member states

|

Country |

Total tax rate (% profit) |

Payments (number) |

Time (hours) |

|

Hungary |

59.3 |

24 |

304 |

|

Estonia |

50.2 |

11 |

104 |

|

Czech Republic |

49 |

14 |

930 |

|

Slovakia |

48.9 |

30 |

344 |

|

Lithuania |

48.4 |

13 |

162 |

|

Latvia |

42.6 |

8 |

320 |

|

Bulgaria |

40.7 |

27 |

616 |

|

Slovenia |

39.4 |

34 |

272 |

|

Poland |

38.4 |

43 |

175 |

Source: Doing business, 2007, World Bank

Taxation of consumption

Taxes on consumption include VAT and excise duties on special goods such as cigarettes and alcohol beverages. Bulgaria has to harmonize its tax regime with that of the European Union by introduction of the minimum excise duties of the European Community on tobacco, alcoholic beverages, and fuels. Starting in 2002 the harmonization process is scheduled to be completed by the end of 2013. In 2007 excise duties on petrol and diesel fuel will increase, while on tobacco and alcohol there will be no price adjustment for next year.

Despite the deductions in the social insurance and corporate tax, the increase of the excise duties and the widening of the tax base due to "lighting up" of a part of the informal economy will ensure greater revenues from indirect taxation than expected. As far as the excises are a part of the taxable base for VAT, the additional excises lead to additional revenues from VAT. This will result again in a budget surplus at the end of 2006.

As a whole, indirect taxes are the largest and most rapidly growing component of tax revenues, accounting for 18.4% of GDP in 2005. In 2006 this share will be even larger.

Some unavoidable truths about taxation

-

High marginal tax rates lead to less payment for each additional unit of labor and as a result, to fewer incentives for work and preference of leisure to labor – this is called a substitution effect of marginal tax rates which reduce economic efficiency by shifting people towards less work and more leisure at the margin.

-

Higher taxes (including social securities burden) mean higher labor costs to employers which serves as a disincentive for businessmen to hire additional workers. This is a cause of higher unemployment.

-

Taxation does not only provide redistribution of incomes and redirection of undertakings to less profitable business sectors due to market signal distortions, but it also generates deadweight loss in the economy – lost revenues that are received neither by the private, nor by the public sector.

-

Taxes of all kinds discourage production by reducing the present incentive for future production of valuable assets and thereby also lower future income and the future level of consumption.

-

Imposing or raising taxes leads to less business activity, e.g. less entrepreneurship and innovations which are the driving forces of the economic growth.

-

High levels of taxation lead to bigger share of shadow economy because the incentives to evade taxation become higher.

-

The forgone revenue for the private sector of each lev taken by the government is greater than one lev due to the multiplication effect of the business activity. This means that the value of the public goods that we receive in exchange of the taxes we pay are less than the value of the goods and services we would gain if we spend all the money we earn by our own.

This list can continue. However, the essence of the theory, proven by facts, is that high taxes decrease economic growth and lead to adverse effects that are greater than the positive effects of supplying public goods. As taxes become higher, economic distortion increase due to rapid expansion of informal economy and corruption practices.

Bulgaria has the lowest level of GDP per capita in 2005 from all EU member states, as well as Croatia and Romania. This is the reason why it is so important for politicians in power to initiate a package of tax cuts in 2007 if they want to improve the economy's lagging performance.

The main objective of tax policy is to raise the amount of revenues needed to fund legitimate functions of government while imposing the least harm to the economy. This is the idea of tax system efficiency. Taking this goal into consideration, a low-rate flat tax is the right approach. It also avoids special preferences and distortions that lead individuals and businesses to make choices based on tax considerations rather than on economic basis. A flat tax also is based on the principle that all taxpayers are equal before the law regardless of how they earn or spend their income, or the level of their income. The system can be both justified from an economic and moral point of view.

Available data and facts also confirm the sound theory that high taxes harm the economy, while lower rates increase the incentives to work, save, invest, and take risks – all at the same time, which leads to economic boost. That is why economies with less corporate tax on average have higher economic growth.

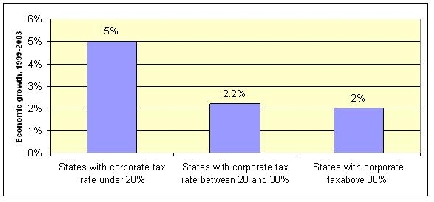

A sample of countries has been used to assess the general impact of corporate tax rates on economic activity. The results unambiguously show that states with lower tax rates experience higher levels of economic performance.

Our proposals about efficient and sound fiscal policy

(Instead of conclusion)

-

§ Abatement of personal income tax, corporate tax and the social security burden – 10% flat rate for all direct taxes.

-

§ Elimination of all tax preferences for special groups (such as farmers) or special goods and services (such as law services or gambling).

-

§ Decrease in the time length of payment of taxes for both legal entities and individuals – by introduction of simpler tax declarations, establishment of working e-government, submission of tax declarations and payment through Internet.

-

§ Public expenditure cuts – through decrease of public sector staff, optimization of the maintenance expenditures, decrease of the subsidies for lossmaking activities, reducing the inefficient meddling in the labor market, transfer of activities to the private sector and faster privatization.

-

§ Reform in the pension system from PAYG to capital-based system, capitalization of the social security and other structural reforms (e.g. in the sphere of education) using the budget surpluses.