No advance payment to the recovery plan: now what?

It now seems almost impossible for Bulgaria to obtain advanced payment under the Plan for recovery and resilience. The amount of the expected advance is up to 13% of the total approved financial package for the country, or a little bit over 1.6 billion BGN. Why is this so? The regulation establishing the “Recovery and Resilience” mechanism clearly states that the Commission makes a pre-financing payment (advance) of up to 13% of financial contribution, provided that the Council adopts the implementing decision by the 31st of December 2021 (i.e., approves the plan and the request for payment). For its part, the indicative timetable for approval provides a recommended deadline up to two months for the European Commission and after those, four more months for the Council. There could be a ruling in a shorter time, of course, take for example the plans approved in the spring for some countries that took about six weeks. At the moment, it seems that the possibility of adopting a Council decision by the end of the year is rather desirable and undoubtedly depends on some possible extraordinary political considerations.

What does that mean? At first, it is not about a difference of a few days or weeks. It is clearly stated in the regulation that the countries are only entitled to receive an advance if the plans are approved by the Commission and the Council by the December 31st. There is no hypothesis that refinancing is envisaged if this approval is obtained, for example, in early January. In other words, countries either want an advance on the basis of a submitted and approved plan by the end of 2021, or they give up on the advance and start implementing the activities under the plan and respectively receive payments (up to) twice a year until 2026. However, requests for regular payments are already subject to the general logic of the Mechanism – namely “money for reform”, in proving the achievement of certain indicators and the implementation of promised reforms according to the approved schedule. There is a strong logic behind this statement – an advance is only viable for these countries, which need the financial resource right now, and the need supposes that the government of the respective country will make efforts to quickly reach a consensus on the national recovery and resilience plan.

Except Bulgaria, the Netherlands has also not yet submitted its national plan. At the same time, Poland and Hungary have sent theirs, but have not received an approval from the European Commission. However, for these two countries, an agreement could be reached (theoretically at least) for days, which gives enough time for a decision by the Council within 2021. For the Netherlands the potential payments under the Mechanism do not have a macro economical dimension and the country does not have a liquidity problem with financing its public expenditures and covering the budget deficit.

At first glance, Bulgaria is in a unique position – the second biggest beneficiary (as a share of the grant in GDP) under the Mechanism and it does not feel the need to hurry or rely upon an advanced payment. However, it is important to pay attention to the motives behind such a decision, which in turn are partly the result of the general economic and fiscal context. The reasons for the postponement are almost obvious – according to Deputy Prime Minister Atanas Pekanov, the Commission expects clear commitments to measures and action in the field of the rule of law and regarding the future of coal-fired power plants. Before the elections, it seems that the caretaker government, which has a mandate not from the current parliament, but from the president, does not want to make commitments that would become the subject of a heated pre-election discussion. At the same time, the government seems to be aware that if it does not carry out more clear and more firm commitments, the Commission will not approve the plan – as what happened in Hungary and Poland, which will also be presented by opponents as evidence of “failure”.

That’s how the political conjuncture logically leads to “postponement”. But what is the economic as well as the strictly budgetary context? If we consider the specifics of the Bulgarian national plan, discussed at least so far, as well as the dynamics of economic activity and budged execution in recent months, the pledge to defuse an advance does not seem so worrying. Here’s what we know at the moment:

Ø The recovery is going faster than expected a year ago, combined with an increase in the overall price level. The Minister of Finance will enjoy an “inflation bonus” – unforeseen revenue growth due to higher turnover in nominal terms. As we have already written, the total public revenues as of the end of September have increased by a higher value even than those set in the updated budget; it seems that even without an advance, revenue growth will exceed the expected cost increase. So even from the point of view of liquidity at the moment there is no particular problem for the implementation of the budget.

Ø Generally speaking, the very idea of advance payments is at the service of countries with high budget deficits, large government debt and hence – funding difficulties. Without making precise forecasts here, it seems that this year as well – after we ended up with the third lowest deficit in the EU in 2020 – the budget deficit will be among the lowest in comparison. If we look at the EC forecast for the summer, only 8 countries are expected to have a deficit below 5% of GDP for 2021, and 7 countries forecast a deficit of over 8%. The countries with the largest advances (see more here) – Italy, Spain and France – are expected to have deficits of 11.7%, 7.6% and 8.5%. These countries need a fiscal transfer, and though soon – they will incur expenditures at the expense of the plan this year and next, and therefore are obviously in a hurry to obtain liquidity.

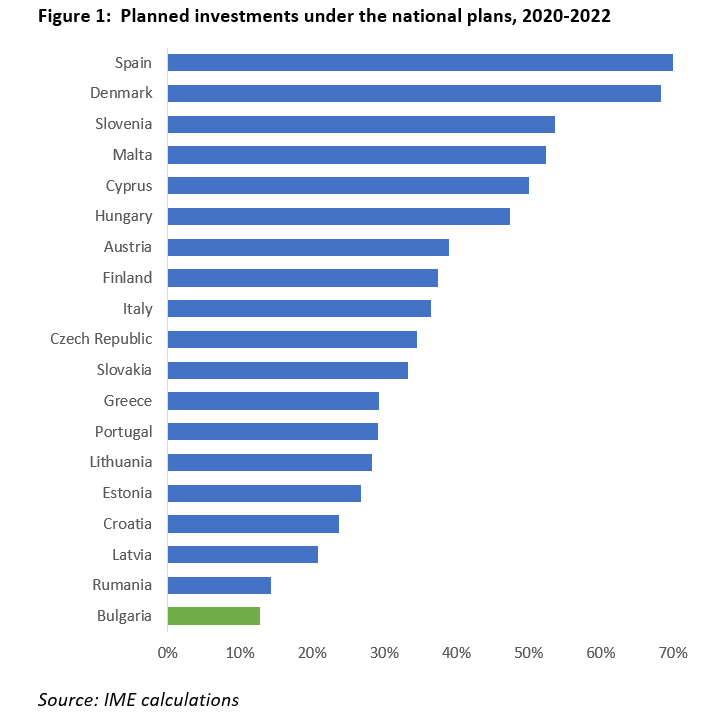

Ø In fact, Bulgaria does not envisage almost any investments at the expense of the Mechanism in 2021 and 2022. As we have already written, our plan is extremely strongly “pulled” forward in time – to the extent that we ask ourselves whether this is a recovery plan or a tool for implementing some investment ideas in addition to cohesion support. According to preliminary estimates, only about 12% of the costs of the entire plan will have to be realized by 2022. For comparison, in other countries this share is about 40%, in Spain it is 70%, in Malta and Cyprus it is about 50%, in Italy is 37%, etc. In other words, while other countries will actually spend significant funds from their budgets – as is the very logic of this instrument in terms of post-crisis recovery and economic transformation – Bulgaria has postponed the idea of public investment anyway. Then such an advance would obviously come as available to the government, and not as a necessary resource for the implementation of projects either this or the beginning of next year.

Ø Remaining in the regime of six-month payments under the plan, this will put the future government under serious pressure in the coming months to reform and implement the goals and measures in the plan – simply because any request for payment must be substantiated and supported by evidence of results.

In this way we could see the recent developments of the events as positive. In any case, there are no failed projects or delayed investments this year due to the lack of an advance – such were never foreseen. Conversely, receiving 1.6 billion BGN at Christmas could have become an argument for another December “distribution” of money – paid with a one-time cash income, but not with a sustainable change in the revenue base. In other words, in the coming turbulent weeks of December, MPs will have to offer expenses without the 1.6 billion levs in question – at least because they could come in 2021, but will not come again in 2022. If there is a demand for resource for different subsidies or an increase of social payments, the future ruling government will be strained by the framework of their capacity for own revenues. Also, the advance will not be able to be used to cover the cash deficit this year or to pay nearly 2.5 billion BGN at the maturity of the 7-year bonds in February 2022. Politicians need to be pressured for budget honesty in front of the taxpayers – there is no way to make deficits by raising costs and paying old debts without incurring new debts. In this sense, the lack of an advance may sober up those who lightly offer new expenses but do not want to be the ones to raise taxes or take out loans. Ultimately, the money under the Mechanism has its purpose – it has to achieve sustainability, recovery and transformation through investment and structural reforms. Bulgarian citizens are interested in the money coming into the account of the government only when and to the extent that it fulfills these goals.

*This document is funded by Active Citizens Fund Bulgaria through the Financial Mechanism of the European Economic Area and Norwegian Financial Mechanism. All its contents are the sole responsibility of Institute for Market Economics and do not represent in any way the views of the Financial Mechanism of the European Economic Area and Norwegian Financial Mechanism and Active Citizens Fund Bulgaria. (www.activecitizensfund.bg)