Exploring the Financial State of Bulgarian SOEs

State-owned enterprises (SOEs) are a very important part of the Bulgarian economy. Their revenue in 2015 equals 13% of GDP, but even that number underestimates their economic impact, because key sectors such as energy, railway transport and water supply are dominated precisely by such enterprises. And although on paper SOEs are not part of the state budget, their financial situation has serious impact on public finances. In 2015 the total amount of subsidies and capital transfers from the state budget to public enterprises is 2.7 billion BGN or 3.1% of GDP, and they have remained relatively stable around 3% of GDP in recent years.

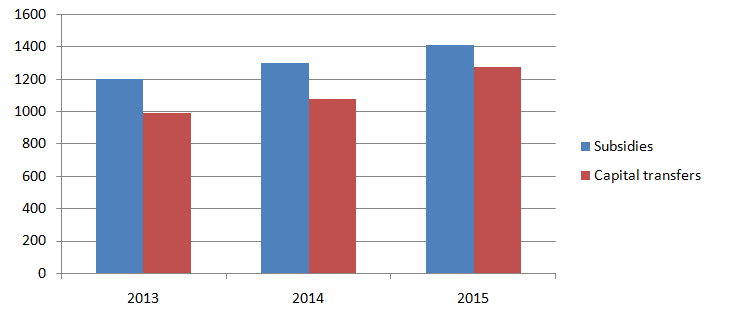

Subsidies and capital transfers from the state budget to public enterprises (mln. BGN) 2013-2015

Source: Ministry of Finance

Despite their importance for the economy and the burden on the budget, no analysis on the financial position of the enterprises in the public sector has been published. This is a serious problem, especially given the fact that in recent years the process of privatization of these enterprises is practically frozen, while subsidies and capital transfers to them continue to grow even faster than GDP.

This led IME to examine the financial position of the public enterprises, trying to also make a financial analysis based on some of the most common secondary indicators of return and indebtedness. For this purpose, we have consolidated the data from the financial statements of all public enterprises (158 in total), for which the Ministry of Finance has published reports on each of the last three reporting years – 2013, 2014 and 2015

The analysis focuses on three main indicators, by which we can gain a relatively complete picture of the financial health of the companies in the public sector. These indicators are:

1) net profit after tax

2) annual return on assets

3) the size and dynamics of indebtedness expressed by the ratio of liabilities to equity

Data show that generally, the financial position of the state-owned enterprises deteriorated in 2014 and 2015 compared to the base year 2013. The number of loss-making enterprises increased significantly to 72 in 2014 and although it dropped 62 in 2015, remains above the level of 55 back in 2013. The overall financial result deteriorated seriously from a 493 mln. BGN net profit in 2013 to a 266 mln. BGN loss in 2014. In 2015 the situation once again improved and a net profit was reported (85 mln. BGN). The liabilities of the enterprises grow in each of the reviewed years and in 2014 the pace of debt accumulation outpaced GDP growth.

The median return on assets is very low. In each of the reviewed years, it is not even approaching 1%, which means that a large part of the SOEs practically do no account any returns. For comparison, in the private sector the recommended return that a company must reach to be considered as a good investment, is about 5%.

The level of indebtedness in general has fallen during the period, but has risen in certain key sectors such as health and energy. It is worrying that the median ratio of debt to equity for enterprises with annual revenues above 100 mln. BGN is six times higher than the median for all enterprises. This clearly shows that the largest and most important companies are most indebted as well.

If we focus on the 10 state-owned enterprises with the highest revenues (which form 78% of the revenues of all SEOs) we will notice that their financial result is significantly worse than the average. Their average revenue is lower than that of all public companies in each of the reviewed years. The same goes for the return on their assets. In 2014 and 2015 the median return on assets of the 10 largest SOEs is negative. Five of these enterprises actually lost money in 2015, compared to three in 2013. As a result of this poor economic performance, their median ratio of debt to equity rapidly rose from 0,83 in 2013 to 1,33 in 2015, which is an increase of over 60%.

It has to be noted, that recently some SOEs have improved their financial situation “on paper” through purely accounting tricks. For example, the level of indebtedness of BDZ-Passenger Services seriously declined in 2015 due to purely accounting entries. As of 31.12.2015 the value of the company’s equity is over 90% higher compared to a year earlier. However, this is mainly due to revaluation of certain fixed assets rather than debt repayment.

In the first half of 2016 there was a similar improvement in the net profit of BDZ Freight Transport, which was mainly due to lower reported depreciation due to change in accounting policy. Such purely accounting improvements do not imply an actual optimization activities of the SOE concerned.

The data show that the financial position of SOEs as a whole has remained bad in recent years – profits are falling, returns are low and even negative in the top ten enterprises and the indebtedness of major players is growing rapidly. Along with the deterioration, however, subsidies and transfers from the state budget to these companies have continued to grow, despite a chronic budget deficit. Furthermore, in recent years the process of privatization is not only frozen, but even is going in the opposite direction – already privatized companies are re-nationalized, while others are added to the restrictions list for privatization. It is high time for the government policy on public enterprises to be revisited by clearing the restrictions list and privatization of most SOEs.