IME REPORT: AFFORDABILITY OF CIGARETTES IN BULGARIA IS IMPROVING, BUT STILL 1.6-1.7 TIMES LOWER THAT THE EU AVERAGE

Affordability of Cigarettes in Bulgaria is Improving, but Still 1.6-1.7 Times Lower that the EU average

IME press release

December 13, 2018

The Institute for Market Economic (IME) published a detailed analysis of price elasticity of tobacco product in Bulgaria and examination of affordability issues in respect to EU harmonization policy on excise duties. The report (see here) is part of IME initiative “By the book”*, which aims to study possible improvements in current policy and the ways to overcome institutional weaknesses which allow for illicit trade of tobacco products. The report covers the full period 2007-2018 and provides commentary on the recent public consultation on EU excise policy towards tobacco products.

Prior IME report (see here) showed that illicit trade of tobacco products in Bulgaria has brought the criminal world between 2.5 and 3.5 billion leva (1.3 to 1.8 billion EUR) for the period 2007-2016. While the illegal market in Bulgaria is at its lowest – around 5-6% in 2017-2018, the revenue for the criminal world is still substantial – around 100-140 million leva (50-70 million EUR) in 2017. In order to better understand the effects of the current excise policy towards tobacco products, IME provides a detailed study of affordability of cigarettes across the EU, as well as the investigation into the price elasticity of cigarettes in Bulgaria – probably the first such study since Bulgaria joined the EU in 2007.

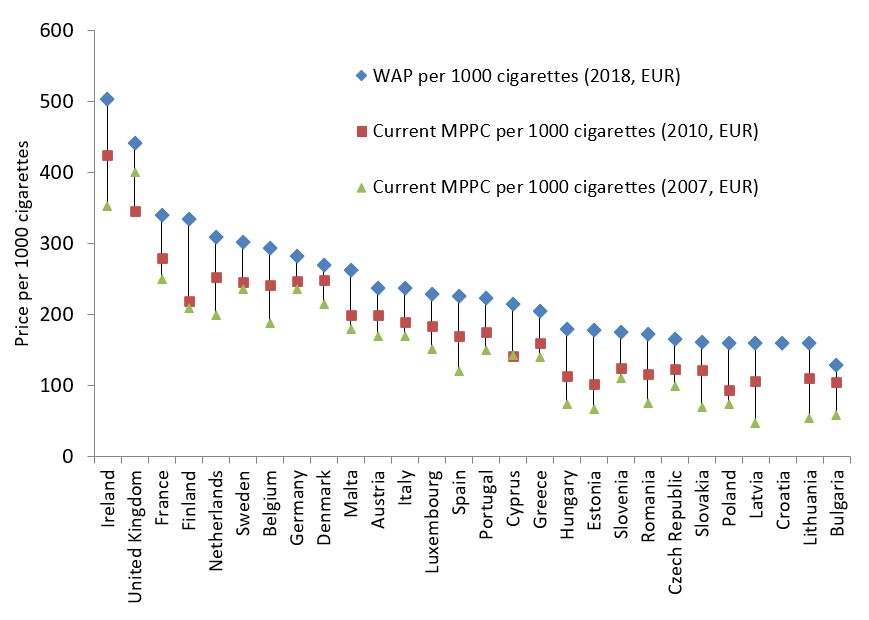

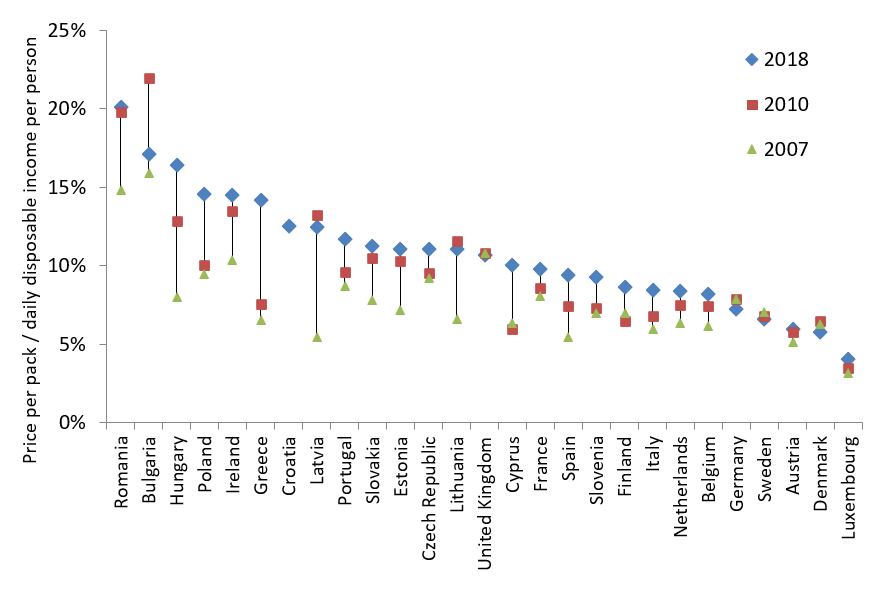

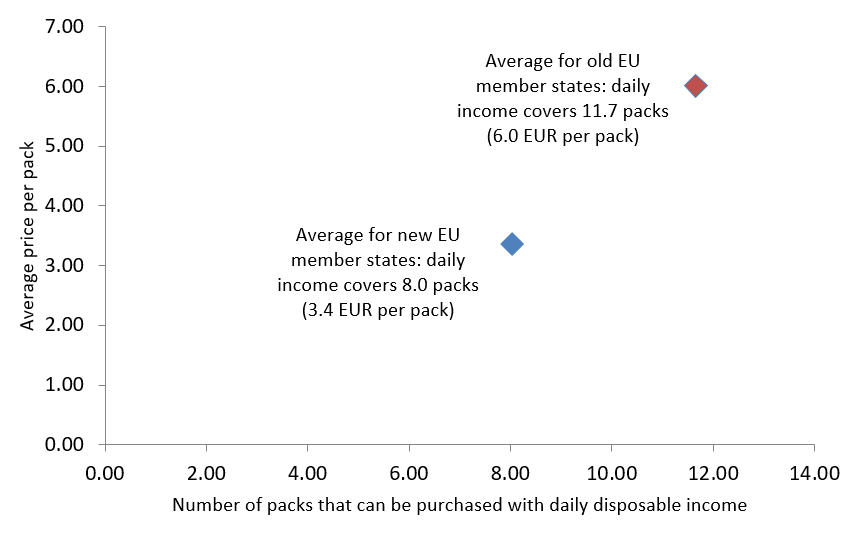

The average price of cigarettes in Bulgaria is 25-30% lower in comparison to the new member states and around 50% of the average price in the EU (excluding UK and Ireland). Nevertheless, three different methodological approaches to affordability of cigarettes within the EU confirm that affordability of cigarettes in Bulgaria is up to 1.6-1.7 times lower in comparison to the EU average. In 2018 with the adjusted net disposable income per person per day in Bulgaria you can buy 5.8 packs of cigarettes, while in the EU you can buy on average 9.3 packs of cigarettes.

Graph 1: Price per 1000 cigarettes in EU countries

Source: Excise Duties Tables, European Commission

Graph 2: Affordability of cigarettes per Daily disposable income

Source: Excise Duties Tables, European Commission; Eurostat; IME

In last 10 years within the EU there is a general trend for affordability of cigarettes to go down, as a result of higher excise duties. This is clearly visible in the new member states and in the southern members – Portugal, Spain, France, Italy and Greece all loose affordability considerably in the last decade. Nevertheless, after 2015 the trend is reversing as affordability in some member states is increasing, even though excise duties are still going up a bit. This is also the case in the poorest member state – Bulgaria, as affordability of cigarettes is increasing in last 3-4 years, due to the high economic growth.

Graph 3: Prices and affordability in new and old EU member states

Source: Excise Duties Tables, European Commission; Eurostat; IME

IME calculations show that price elasticity of cigarettes in Bulgaria for the period 2007-2017 is relatively high – reaching -0.95. Calculations are taking into account not only the changes in prices, but more precisely changes in affordability. Such high elasticity means that the consumers are reacting considerably in any change in affordability – limiting their consumption of cigarettes, but also searching for illicit products, as they are cheaper. While prices of cigarettes basically doubled in last ten years, the affordability of cigarettes went down by around 29%. In the same period the consumption of legal cigarettes dropped by 27.6%. IME estimations show that the price elasticity of cigarettes in Bulgaria is relatively high and above what was generally expected, based on the theory and international experience.

IME field study among 5200 smokers in Bulgaria (March-April 2018) is allowing us to investigate deeper consumer behaviour when prices of cigarettes are increasing. It is important to note, that price elasticity is increasing when the increase of prices is steeper – from around -0.50 when the price is increasing with up to 4 or 10 percent, to as high as -1.00 when the price is increasing with up to 20 or 40 percent. We should also take into account that consumers are probably overstating their reactions. There is a clear difference in price elasticity between the richer and poorer smokers, as well as between smokers that are working and retirees.

This means that the social status and difference in income are important, as different groups react differently to changes in prices. Theory also suggests that countries that have higher levels of income inequality should take that consideration seriously. Interestingly enough, smokers that are retirees, are much less inclined into using illicit cigarettes in comparison to the smokers in working age.

IME review of EU consultation on the possible changes in the excise duties on tobacco products shows what are seen as the main goals of EU harmonization policy. There is obviously limited support for the nominal reduction of price differences between member states to be seen as a central goal of EU policy. Policy goals which are widely supported are clear common rules to define and classify tobacco products, protection of public health and limiting illicit trade of tobacco and tax fraud. In that respect, the discussion on affordability of cigarettes and price elasticity in the poorest member state in the EU is extremely important. While the general framework within the EU will probably stay as it is now, the discussion of possible new EU-wide excise targets will continue and many member states will probably continue the general trend of rising excise duties on tobacco products on their own.

The developments in some of the new member-states, also in Bulgaria, show that in recent 3-4 years affordability of cigarettes increased even though the excise duties increased. This allowed for the illegal market not to grow and budget revenues to stay strong – estimations show that government revenues in 2018 from tobacco products (excise duties and VAT) will reach 3 billion BGN (1,5 billion EUR). As there will be no major changes in 2019, we expect that affordability of cigarettes in Bulgaria will continue to improve.

While this may allow for additional increases in excise duties on tobacco products in the mid-term, the policy should take into account affordability (increasing excise duties only in the good years) and also follow the rules of successful policy that we discussed in the last paper – mainly predictability (introducing excise calendar) and graduality (avoiding tax shocks). In addition, strict control over the process of manufacturing of tobacco products in Bulgaria should be maintained.

|

More information on IME webpage: www.ime.bg The full report is available here.

|

Contacts: 02/952 62 66, 952 35 03 Petar Ganev, [email protected] |

*This publication is part of IME project “Law and Economics of Illegal Trade of Tobacco Products in Bulgaria”. The project is funded by PMI IMPACT[1], a global grant initiative by Philip Morris International to support projects dedicated to fighting illicit trade and related crimes.

[1] PMI IMPACT (www.pmi-impact.com) is a grant award initiative of Philip Morris International (“PMI”). In the performance of its research, IME maintained full independence from PMI. The views and opinions expressed in this document are those of IME and do not necessarily reflect the views of PMI. Responsibility for the information and views expressed in this publication lies entirely with IME