The fictitious “real convergence” criterion for the euro area

For some time, any attempt by a Bulgarian politician to raise the topic of accession to the eurozone of Bulgaria is usually received by European politicians with the argument that it is still early. It is early, these politicians say, because Bulgaria, while fulfilling the nominal membership criteria, must make further efforts to achieve the so-called “real convergence” to the eurozone.

This popular argument for real convergence or income convergence towards the average European level appears to have appeared in the last 2-3 years after the country succeeded in achieving the Maastricht criteria for membership over several consecutive periods. In parallel, the bankruptcy of the fourth largest bank, Corporate Commercial Bank, in 2014 has shown that membership to the eurozone and its banking union, with a single supervisory mechanism for European banks, is not a bad idea after all. Thus, supporters for starting a process of joining the euro area have multiplied in recent years and have been joined by politicians from most parties as well as experts, representatives of employers, trade unions, academia and others.

The ensuing diplomatic offensive this time came from representatives of the European Commission, the ECB and other European institutions, arguing that the real convergence of the Bulgarian economy to that of the eurozone countries has not yet happened and Bulgaria has to wait.

We must note here that there is no such a criterion as real convergence neither for the eurozone nor for the so-called eurozone waiting room – Exchange Rate Mechanism II (ERM II); consequently there are no numerical thresholds for any indicators that are expected to be achieved. In fact, there are no formal criteria for ERM II at all and the decision to allow a country to the ERM II is mostly political, with the definite blessing of the ECB.

With this in mind, the “requirement” to achieve real convergence is actually something like a euphemistic response of the sort: “We will see, but rather, there is no political consensus on it at the moment.” While there is no formal definition of “real convergence”, the economic slang for it is usually understood as GDP per capita in purchasing power standard (PPS). Thus, it is a measure of well-being and real incomes in an economy. The purchasing power standard allows for international comparisons of these incomes, with one euro in PPS purchasing the same goods and services in all EU countries.

Nevertheless, let’s assume for a moment that there is a somewhat informal criterion for starting a eurozone accession process called ‘real convergence’. Let’s then look at how selected Central and Eastern European (CEE) countries fared against this criterion at that point when they were admitted to the ERM II and thus started their accession process.

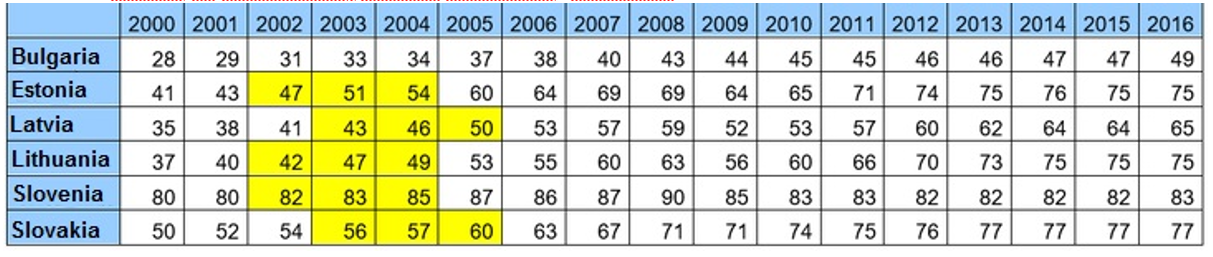

The CEE countries that joined the eurozone in the last few years had been admitted to the eurozone waiting room between 2004 and 2005 without exception (see the table below).

The moment of accession to ERM II and the eurozone for selected EU Member States

|

entry to ERM II |

entry to the eurozone |

|

|

Cyprus |

29.5.2005 |

1.1.2008 |

|

Estonia |

27.6.2004 |

1.1.2011 |

|

Latvia |

2.5.2005 |

1.1.2014 |

|

Lithuania |

27.5.2004 |

1.1.2015 |

|

Malta |

2.5.2005 |

1.1.2008 |

|

Slovakia |

25.11.2005 |

1.1.2009 |

|

Slovenia |

27.6.2004 |

1.1.2007 |

Source: EC, ECB

If we exclude Malta and Cyprus, as they have very different economies from those in the former socialist countries of Central and Eastern Europe, it can be seen from the second table that GDP per capita (in PPS) in Estonia, Latvia, Lithuania, Slovakia and Slovenia at the time of their accession was similar to the current volume of GDP per capita for Bulgaria (as % of the EU average). Only Slovenia shows a significantly higher GDP per capita at the time of its accession to the Exchange Rate Mechanism II, but its economy is also very different from that of most other former socialist republics.

GDP per capita in purchasing power standard (volumes), EU-28 = 100

Source: Eurostat

Given that Lithuania and Estonia joined the ERM-2 in May and June 2004, respectively, at that time the most recent available data on GDP per capita in PPS referred to 2002 or, at best, 2003 (if some preliminary data had been made public). Thus, incomes in Lithuania were 42% (2002) or 47% (2003) of the EU average, while those in Estonia – 47% (2002) or 51% (2003) of the EU average. The situation is similar in another Baltic republic, Latvia, which was admitted to ERM II in 2005. The two years before its entry to ERM II, its GDP per capita was 43% and 46% of the average EU-28 level, respectively. In Slovakia, GDP per capita in PPS was 56-57% in the two years before joining ERM II.

For comparison, GDP per capita in Bulgaria (in PPS) is 49% of the EU-28 average, according to latest data (2016). Probably, in 2017, it has managed to pass the 50% limit, given the good growth of the economy, which outpaced about 2 times the EU average. It turns out that at the moment, with regard to the “criterion” for real convergence Bulgaria is performing even better than a part of the countries that joined ERM II and the euro area in the last 15 years. Lithuania and Latvia were in a worse position on this criterion at the time of accession, and Estonia was in a similar situation as Bulgaria. Only Slovakia had higher incomes (56-57% of EU-28 = 100), but even here differences with Bulgaria are not that significant. Of course, GDP per capita in PPS for these countries has grown markedly, by some 15-25 points, by the time of euro adoption (Estonia – 2011, Latvia – 2014, Lithuania – 2015). However, the question here is about real incomes at the time of admission to ERM II and only this question should be relevant to Bulgaria`s case and its stated ambitions to be admitted to the Exchange Rate Mechanism II.

To summarize, even if there were an informal criterion for real convergence of incomes to the EU average, then Bulgaria would have fulfilled it. This is clearly evident from the decision to admit the three Baltic States to ERM II at income levels that had been lower or similar to those of Bulgaria at the moment. The other possible explanation lies in the domain of political hypocrisy and the use of euphemisms behind which European politicians (like most politicians) usually hide. Which of the two explanations is relevant to the case will be seen pretty soon if the Bulgarian Finance Minister fulfills his promise and files an application for euro adoption by June this year.

* Vesela Krastanova is a trainee at the IME.