Is the Flat Tax the Biggest Problem of Bulgarian Economy

If anyone traces the election debates in the media he will get the impression that the flat income tax is probably the most important problem to be solved after the election. Whether to keep it or to introduce personal allowance and how much it should be, whether to introduce some progressiveness for income above certain amount in order to punish the “rich” ones with higher taxes, etc. Representatives of all parties without exception enter into this discussion with fervor and enthusiasm, without cherishing time and words in convincing us in their view.

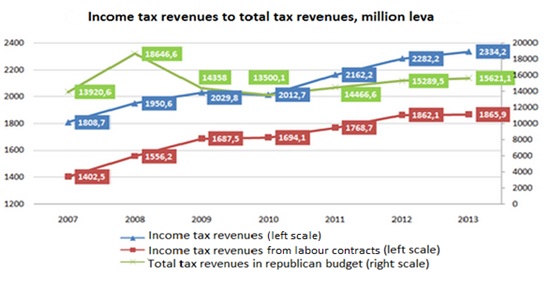

What statistics shows so far about the proportional (known as “flat”) tax is that it works successfully more than six years: generates constant increase of the revenues from this tax in the budget and encourage people to work more and declare their income. Unlike many other government policies and systems that do not work or survive on “artificial respiration” sustained by the state – pension system, health care, education, home affairs, judiciary and administration of justice, energy policy, administrative services, etc.

But the question about these government systems failures and the emergency need for reform is conveniently not raised in the pre-election debates or if it is raised it is not so serious and concrete proposals for change are not discussed. The flat tax is much more comfortable debate topic. The arguments of the proportional tax opponents has nothing to do with numbers and economic theory and they only spin around some subjective sense of justice – according to them it is fair to seizure as much as possible from the so called “rich” in order to punish them for their high income. No one, however, bares in mind the simple economic relation[1] that higher taxes mean more gray economy, because the so-called rich people will always find a way to circumvent the payment. And vice versa – lower taxes stimulate exposing economy to “light”.

That was clearly seen after the introduction of the proportional 10 percent income tax in 2008 right before the crisis. Although the big decrease of the number of working places (nearly half million between 2009 and 2012) the income tax on individuals settled in the employment contract was the only tax revenues which did not stop increasing during the toughest years for the economy and the budget.

Source: Ministry of Finance of Bulgaria

The graph shows distinctly that while the total tax revenues dropped sharply in the republican budget in 2009, income tax revenues were still growing – and this despite the loss of more than 100 000 working places only in 2009. The one and only explanation for the gap between the dynamics of income tax revenues and the number of employed people is that the economy is enlightened – exactly at the employment contracts.

It should be borne in mind that taxes on personal income include not only the 10% rate for income from labour contracts but also patent tax (which rates are another) and income taxes on copyright, creative and other similar activities in which the tax is actually lower because of a certain percentage deduction on acknowledged costs. Given this, to check how it works and how effective the proportional income tax is, the most appropriate would be to consider only the revenues from income tax from labour contracts. Revenues from this tax were growing every year from 2008 to 2013 – even in 2010, when the total revenues from taxes on personal income decreased slightly with 17 million leva. This positive trend continues in 2014, as for the first seven months revenues from income tax from labor relations reached 1.19 billion leva compared to 1.04 billion leva one year earlier, i.e. increased by about 153 million leva.

Thus for the flat tax – the convenient “gum” in election debates which allows running away from the really problematic and difficult topics. It would not be bad the next time when someone starts “fighting” against this tax to take into account the numbers above. It would be nice also to explain how exactly the generally sure loss of revenue in the budget will be compensated if a progressive scale of taxation is re-introduced. Because loss will inevitably occur as a result from increased grey economy, the outflow of investors and the higher cost of tax administration for collecting the tax.

[1] Discovered and described by Arthur Laffer with his Laffer ‘s curve, but repeatedly proven with empirical data afterwards.