Do We Need The Minimal Social Insurance Thresholds?!

In 2003 the Bulgarian government introduced new insurance thresholds for 48 economic activities and professions. The primary goal of the lawmakers was to increase the collectability of social security payments and to fill the gap in the pension system. Now nine years later these thresholds are determined each year with a particular law and are being applied to 80 different economic sectors.

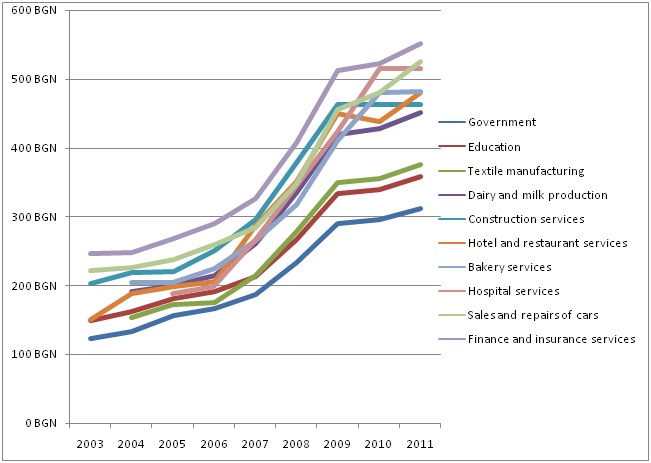

In the next graph are shown the different minimal insurance thresholds for 10 professions with around 1 million people employed or roughly half the working force in the country.

Graph 1: Minimal Social Insurance Thresholds 2003-2011 (BGN)

Source: State Social Security Budget Law

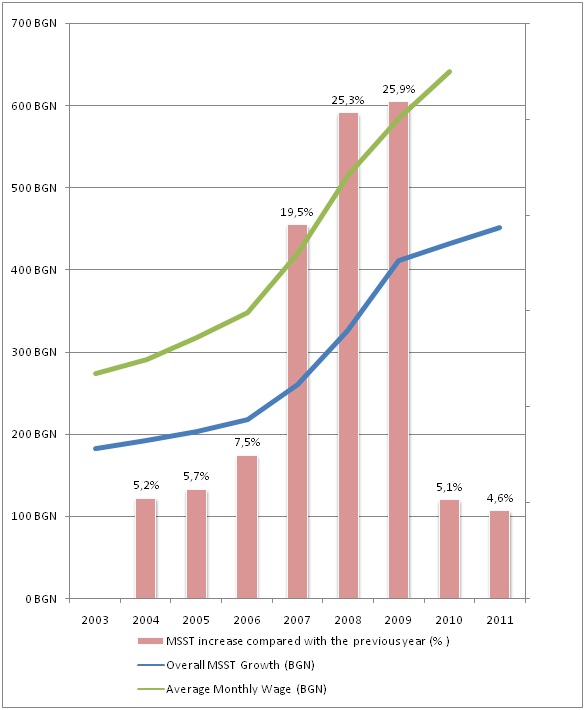

Except the increase in absolute terms for these 10 economic activities it is important to take notice of the overall increase in the minimal insurance thresholds.

Graph 2: Average growth of the minimal social security thresholds (MSST) for 10 professions 2003-2011 and average wage

Source: State Social Security Budget Laws, calculations IME

It is obvious that the minimal social security thresholds have increased significantly through the years. The growth rate has been different, for example during the previous cabinet there were years with over 25% growth. The overall increase since the introduction of the thresholds is 250%.

What is interesting is that the average wage is growing together with the minimal thresholds, in practice the officially declared income is determined by the administrative minimum. It seems that the government has not achieved its goal to persuade workers to pay social security insurance on their real income. With the introduction of the minimal thresholds the administration sets something like the lowest acceptable level of cheating (in case the workers want to lie about their income anyway).

The situation has links to the failing pension system. The lawmakers have put forward a list of sub-targets to hide the fact that taxpayers are actually paying for the lack of adequate pension reform:

- To serve as a countermeasure against the shadow economy – the introduction of the thresholds actually lead to an increase of the size of the shadow economy, and their constant growth forces more and more people to work without paying the real size of their insurances.

- To provide financial stability for the pension system – the current pension system cannot be stable until we have a real pension reform, the social security deficit will continue to grow and with it the need for ever larger thresholds.

- To insure fair remuneration for the workers – the income growth induced by the administration actually leaves many people (especially less-qualified workers) without jobs.

The effects of the introduction of the minimal social insurance thresholds can play a significant role in the labour market and can be really important for the economy. In 2009 IME prepared an impact assessment on the minimal social insurance thresholds which shows that a 26.6% increase of the thresholds will lead to over 544 million (BGN) losses for a single year and over 4.65 billion (BGN) for a 10 year period.

There is one solution for the current situation – removal of all minimal social insurance thresholds combined with a real pension reform which will increase private saving and will lead to economic growth.